Loan Ontario: Essential Tips for a Smooth Borrowing Experience

Loan Ontario: Essential Tips for a Smooth Borrowing Experience

Blog Article

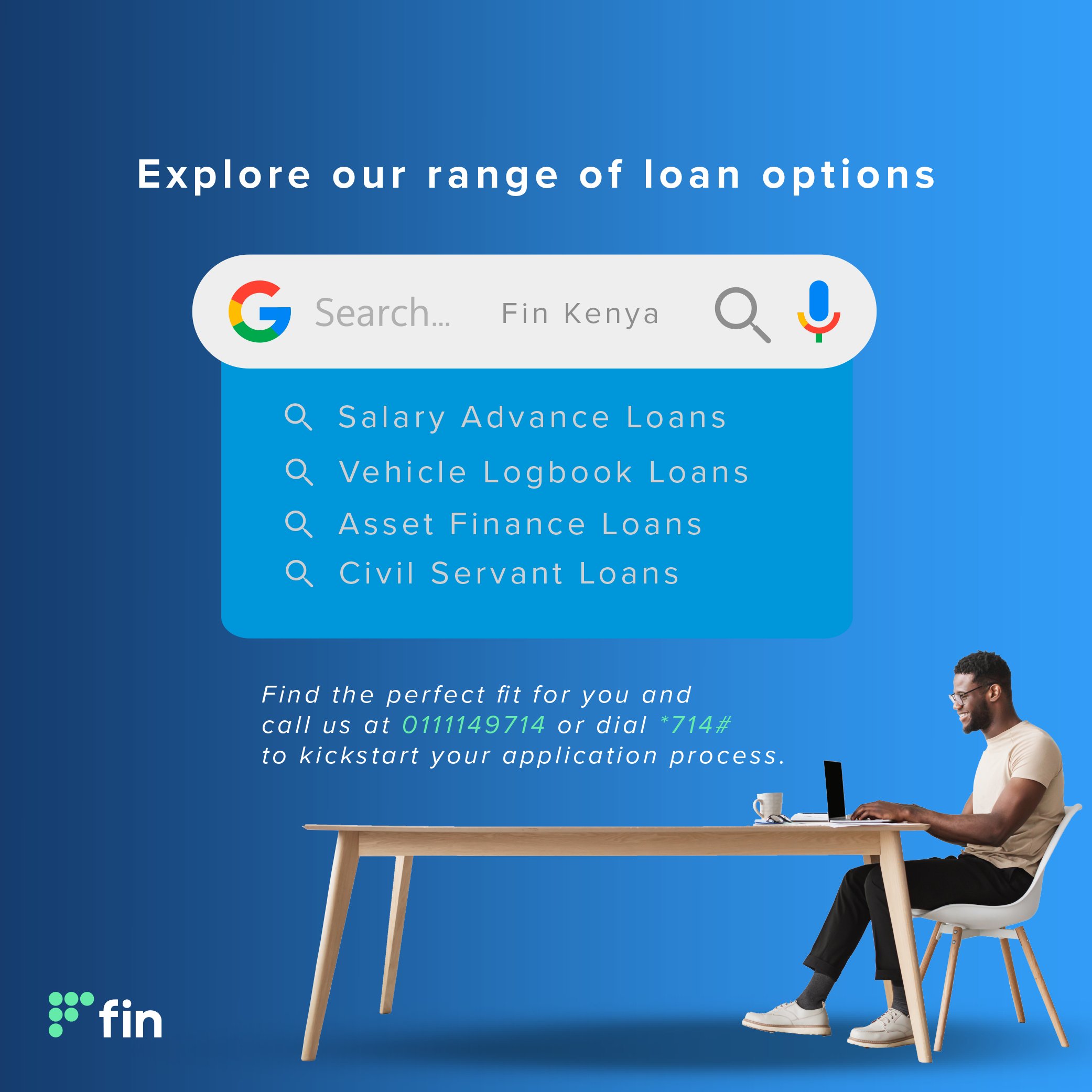

Unlock Your Financial Prospective With Easy Car Loan Providers You Can Count On

In the world of individual money, the schedule of convenient loan solutions can be a game-changer for individuals aiming to open their monetary capacity. When looking for monetary aid, the integrity and trustworthiness of the loan company are critical considerations. A myriad of funding alternatives exist, each with its own collection of considerations and benefits. Recognizing how to browse this landscape can make a considerable distinction in achieving your monetary goals. As we check out the world of problem-free finances and trusted services better, we uncover crucial understandings that can equip people to make educated choices and secure a stable financial future.

Advantages of Hassle-Free Loans

Problem-free loans offer borrowers a structured and efficient means to accessibility economic aid without unnecessary difficulties or delays. Among the primary benefits of hassle-free lendings is the fast approval procedure. Typical loans usually involve prolonged documentation and authorization periods, causing delays for individuals in immediate need of funds. On the other hand, easy fundings prioritize rate and comfort, providing borrowers with rapid access to the money they call for. This expedited procedure can be particularly beneficial throughout emergency situations or unexpected economic circumstances.

Moreover, problem-free loans normally have marginal qualification requirements, making them obtainable to a more comprehensive variety of people. Standard lending institutions frequently require comprehensive documents, high credit rating, or security, which can leave out numerous possible debtors. Convenient car loans, on the various other hand, concentrate on affordability and versatility, offering help to people that may not satisfy the strict demands of traditional banks.

Kinds of Trustworthy Funding Provider

Just How to Get approved for a Loan

Exploring the crucial qualification requirements is vital for individuals looking for to receive a funding this in today's economic landscape. When establishing a customer's eligibility for a financing, Lenders usually analyze a number of factors. One of the key factors to consider is the candidate's credit history. An excellent credit report shows a background of accountable monetary habits, making the borrower much less risky in the eyes of the lending institution. Revenue and employment standing likewise play a substantial function in the car loan approval process (loan ontario). Lenders need assurance that the customer has a stable revenue to pay back the loan promptly. In addition, the debt-to-income ratio is a crucial metric that loan providers utilize to examine an individual's ability to take care of extra debt. Giving exact and updated financial information, such as tax returns and bank declarations, is important when making an application for a car loan. By recognizing and meeting these eligibility requirements, people can enhance their opportunities of certifying for a financing and accessing the monetary aid they require.

Managing Financing Repayments Carefully

When customers successfully safeguard a lending by satisfying the key qualification standards, sensible management of lending settlements becomes paramount for preserving economic security and creditworthiness. Timely payment is crucial to prevent late charges, penalties, and negative influence on credit report. To take care of funding payments carefully, debtors need to create a spending plan that consists of the monthly settlement quantity. Establishing automatic i loved this payments can aid make certain that payments are made on schedule every month. Furthermore, it's suggested to focus on loan payments to stay clear of dropping behind. In instances of financial problems, connecting with the lender proactively can in some cases bring about alternative settlement setups. Keeping track of credit rating records frequently can likewise assist borrowers remain notified regarding their credit history standing and recognize any type of inconsistencies that might require to be addressed. By managing financing repayments properly, borrowers can not only fulfill their monetary commitments however likewise develop a positive credit rating that can benefit them in future financial undertakings.

Tips for Selecting the Right Finance Option

Selecting the most appropriate lending choice includes comprehensive study and consideration of individual economic demands and scenarios. Take into consideration the loan's total cost, payment terms, and any added fees connected with the finance.

Furthermore, it's important to choose a lending that straightens with your economic goals. By complying with these ideas, you can with confidence select the appropriate car loan option that assists you achieve your financial purposes.

Conclusion

Finally, opening your monetary capacity with easy finance solutions that you can trust is a accountable and wise choice. By comprehending the benefits of these finances, understanding exactly how to receive them, handling settlements sensibly, and choosing the appropriate car loan alternative, you can attain your economic objectives with self-confidence and comfort. Trustworthy lending solutions can supply the support you require to take control of your funds and reach your wanted end results.

Guaranteed car loans, such as home equity fundings or automobile title finances, permit borrowers to use security to safeguard lower passion rates, making them a suitable option for individuals with beneficial possessions.When borrowers efficiently protect a loan by meeting the crucial qualification standards, sensible monitoring of loan payments comes to be vital for keeping monetary stability and credit reliability. By handling car loan payments properly, borrowers can not only accomplish their economic obligations description however also construct a positive credit score history that can benefit them in future financial undertakings.

Take into consideration the car loan's overall price, settlement terms, and any type of added charges associated with the financing.

Report this page